Americans Renouncing Citizenship at Record High

It all goes back to the Civil War.

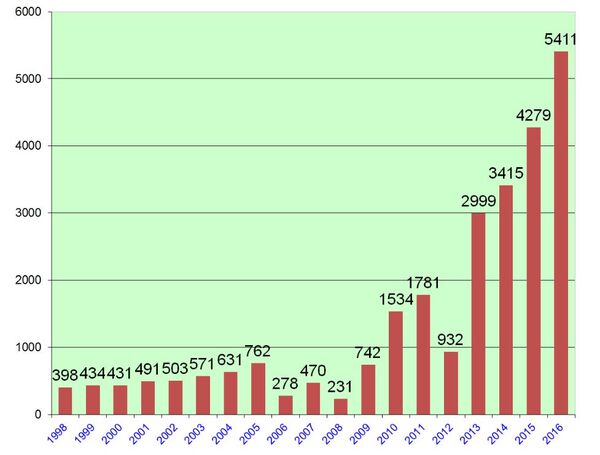

The number of Americans renouncing their citizenship rose to a new record of 5,411 last year, up 26 percent from 2015, according to the latest government data.

Why?

It all goes back to the Civil War, and to a tax meant to deter potential draft dodgers from leaving the U.S. Today, the goal is to make sure that all of the income of U.S. citizens, whether they live and work in the U.S. or not, is reported to the Internal Revenue Service.

The rules got trickier in 2010, when, in an effort to cut down on tax evasion, the Foreign Account Tax Compliance Act (fabulously, Fatca, for short) was passed into law. It basically said foreign institutions holding assets for U.S. citizens had to report the accounts or withhold a 30 percent tax on them if the information wasn't provided. That led some foreign banks to shy away from opening accounts for expats.Since Fatca came into being, annual totals for Americans renouncing citizenship have reached their four highest historic levels, as shown in the chart below from Andrew Mitchel LLC and its International Tax Blog.

Source: U.S. Treasury Department via Andrew Mitchel LLC

Among the names on the 2016 list of those bidding adieu to the U.S. and its tax code was the U.K.'s foreign secretary, Boris Johnson, who was born in New York. Boldface names from years past (some really past) include the torch song master Josephine Baker, the actor Yul Brynner, the great soprano Maria Callas, businessmen Kenneth and Robert Dart, investor Mark Mobius, and Eduardo Saverin, a co-founder of Facebook.

2016 Fourth Quarter Published Expatriates – New Annual Record

Today the Treasury Department published the names of individuals who renounced their U.S. citizenship or terminated their long-term U.S. residency ("expatriated") during the fourth quarter of 2016.

The number of published expatriates for the quarter was 2,365, bringing the total number of published expatriates in 2016 to 5,411. The total for the year breaks last year's record number of 4,279 published expatriates. The number of expatriates for 2016 is a 26% increase over 2015 and a 58% increase over 2014 (3,415). For a discussion of how the IRS compiles the data, see these posts: missing names, source of data.

The escalation of offshore penalties over the last 20 years is likely contributing to the increased incidence of expatriation.

We have created two graphs which reflect the latest expatriation data. The graph above is based solely on IRS data and shows the number of published expatriates per year since 1998. The graph below shows data going back to 1962 by incorporating State Department data. For the source of the State Department data, see this post.

Interestingly, Boris Johnson, the UK Secretary of State for Foreign and Commonwealth Affairs (and former Mayor of London), appears to be on the list. Also, Alexander Friedrich Antonius Johannes Von Hohenzollern, also known as Alexander, Hereditary Prince of Hohenzollern appears to be on the list.

For our prior coverage of expatriation, see all posts tagged Expatriation.

^ed

No comments:

Post a Comment